b&o tax seattle

License and tax administration 206 684-8484 taxseattlegov. Have a Seattle business license see the due dates for that here file a business license tax return.

Create a tax preparer account to file returns for multiple clients example.

. Washingtons BO tax is calculated on the gross income from activities. If your business is a retail store and you are filing a local tax return for 2017 the tax rate you will pay is 000219 or 219. To 5 pm Monday-Friday excluding City holidays.

The state BO tax is a gross receipts tax. This means there are no deductions from the BO tax for labor. The tax amount is based on the value of the manufactured products or by-products.

Entities engaging in business inside the Seattle city limits are required to pay a business and occupation BO tax. For calls 206 684-8484. You only have to pay tax if your gross revenue is 100000 or more.

Seattle BO Tax. Business occupation tax classifications. BEFORE YOU GET STARTED.

The amount of tax is equal to the gross income of the business from parimutuel wagering multiplied by the rate of 01 percent through. You pay the tax if your annual taxable gross revenue is 100000 or more. Please have your City of Seattle customer number ready to provide to the representative.

Compare - Message - Hire - Done. If you do business in Seattle you must have a Seattle Business license and file the business license tax return which is the BO tax. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. 7386494 or more of payroll expense in Seattle for the past calendar year 2021 and.

Box 34214 Seattle WA 98124-4214. Ad Top-rated pros for any project. Called the Business Occupation Tax the BO is loathed with the intensity usually reserved for your college football teams archrival.

32 rows Business occupation tax classifications Print. Specialized BO tax classifications. 8 2022 our public hours will change to 830 am.

24 2020 the Washington Court of Appeals determined that the city of Seattle used an unlawful method to calculate the citys Business and Occupation BO tax liability of a broker-dealer taxpayer. CREATE BUSINESS ACCOUNT View the Taxpayer Quick Start Guide. Thumbtack - find a trusted and affordable pro in minutes.

The BO tax is calculated based on gross business receipts less allowable deductions and businesses fall into one of two rate categories. If you do business in Seattle you must. It is measured on the value of products gross proceeds of sale or gross income of the business.

Think the Apple Cup but with lots more money at stake. The payroll expense tax in 2022 is required of businesses with. Ad Based On Circumstances You May Already Qualify For Tax Relief.

They must pay business and occupation BO tax on gross revenues generated from regular business activities they conduct. This table below summarizes Seattle business license tax rates and classifications. The model was updated in 2007 2012 and 2019EHB 2005 passed in 2017 also established a task force of city and business representatives to recommend changes to the two-factor apportionment formula for service income under RCW.

Box 34214 Seattle. You may also reach us via email recommended at taxseattlegov or by phone at 206 684-8484 from 8 am. Get a free estimate today.

Washington unlike many other states does not have an income tax. They must pay sales tax on all goods and retail services they purchase as consumers such as supplies lodging equipment and construction. Effective July 1 2005 a new BO tax is imposed on persons engaging within this state in the business of conducting race meets for which a license must be obtained from the Washington Horse Racing Commission.

The Infamous BO Tax. Compensation in Seattle for the current calendar year 2022 paid to at least one employee whose annual compensation is 158282 or more. Service other activities015.

In Washington nonprofit organizations are generally taxed like any other business. Manufacturing Processing for Hire Extracting Printing. The State isnt the only one with BO taxes Seattle requires them as well.

For calls 206 684-8484 and in-person meetings by appointment only on Tuesdays and Wednesdays. Create a business account to register your business file returns and pay local BO taxes. See If You Qualify For IRS Fresh Start Program.

Extracting Extracting for Hire00484. Open Monday through Friday 8 am-5 pm. Free Case Review Begin Online.

8 2022 our public hours will change to 830 am. Nobody likes taxes but people really really hate the levy Washington imposes on businesses. License and Tax Administration 206-684-8484 taxseattlegov.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. CPAs and accounting firms. 1 Specifically Seattle unfairly apportioned the tax by excluding amounts paid to independent contractors from the taxpayers payroll factor.

If your business is a professional services firm like a law or accounting firm and you are filing a local tax return.

Understanding The Mayor S Proposed Budget Revenues

Understanding The Mayor S Proposed Budget Revenues

Understanding The Mayor S Proposed Budget Revenues

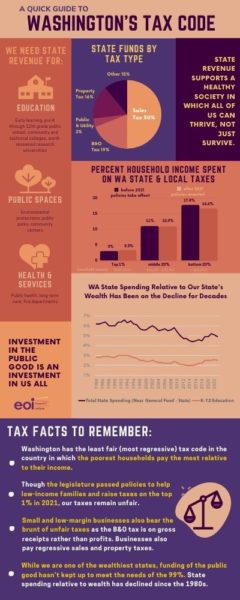

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute

Understanding The Mayor S Proposed Budget Revenues

Urgent Vulnerable Patient Health Care Jeopardized By Proposed B O Tax Increase King County Medical Society

Understanding The Mayor S Proposed Budget Revenues

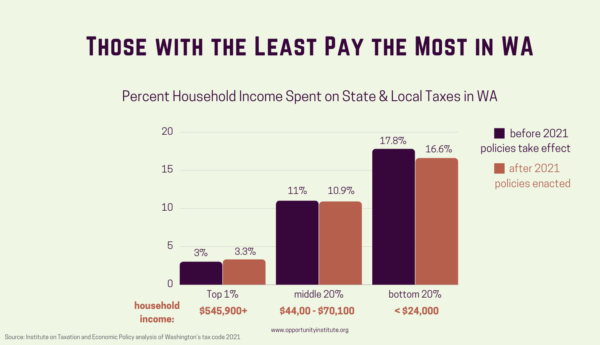

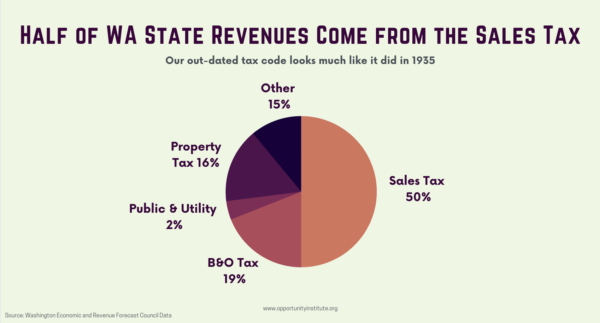

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute